By taking advantage of the 3-year tax holiday, media houses can enhance their operational capacities, improve content quality, and contribute to the overall growth of the media industry

PRESS STATEMENT

For Immediate Release

LUSAKA – MISA Zambia commends the government for its forward-thinking approach in fostering the growth and development of the media industry through the recent announcement of a 3-year tax holiday on broadcasting equipment.

This landmark initiative, as outlined in Statutory Instrument No. 67 of 2023, presents an invaluable opportunity for both newly licensed and existing broadcasting stations to enhance their capabilities and contribute to the enrichment of the media landscape.

The 3-year suspension of Customs and Excise duty, extending until December 31, 2026, is a significant step towards promoting technological advancement and innovation within the broadcasting sector. MISA Zambia recognizes the government’s commitment to creating an environment that supports media organizations in their pursuit of excellence.

In light of this, MISA Zambia urges all newly licensed stations and existing broadcasting entities to seize this opportunity to import new broadcasting equipment or upgrade their existing infrastructure. This tax holiday is a strategic move that not only encourages technological investments but also ensures that media houses stay at the forefront of delivering high-quality content to the public.

The media plays a pivotal role in shaping public discourse, disseminating information, and fostering societal development. By taking advantage of the 3-year tax holiday, media houses can enhance their operational capacities, improve content quality, and contribute to the overall growth of the media industry.

MISA Zambia encourages media houses to review the attached Statutory Instrument No. 67 of 2023 for detailed information and guidelines regarding the tax holiday. This comprehensive document provides the necessary insights for broadcasters to navigate the benefits of the initiative seamlessly.

We believe that this tax holiday will empower media organizations to make substantial contributions to the socio-economic development of Zambia. As the media landscape evolves, embracing modern broadcasting equipment is vital for staying competitive and meeting the ever-changing demands of audiences.

MISA Zambia calls upon all stakeholders, including government agencies, industry players, and the public, to support and promote the effective utilization of this tax holiday for the betterment of the media sector and, by extension, the nation.

Issued by

MISA Zambia

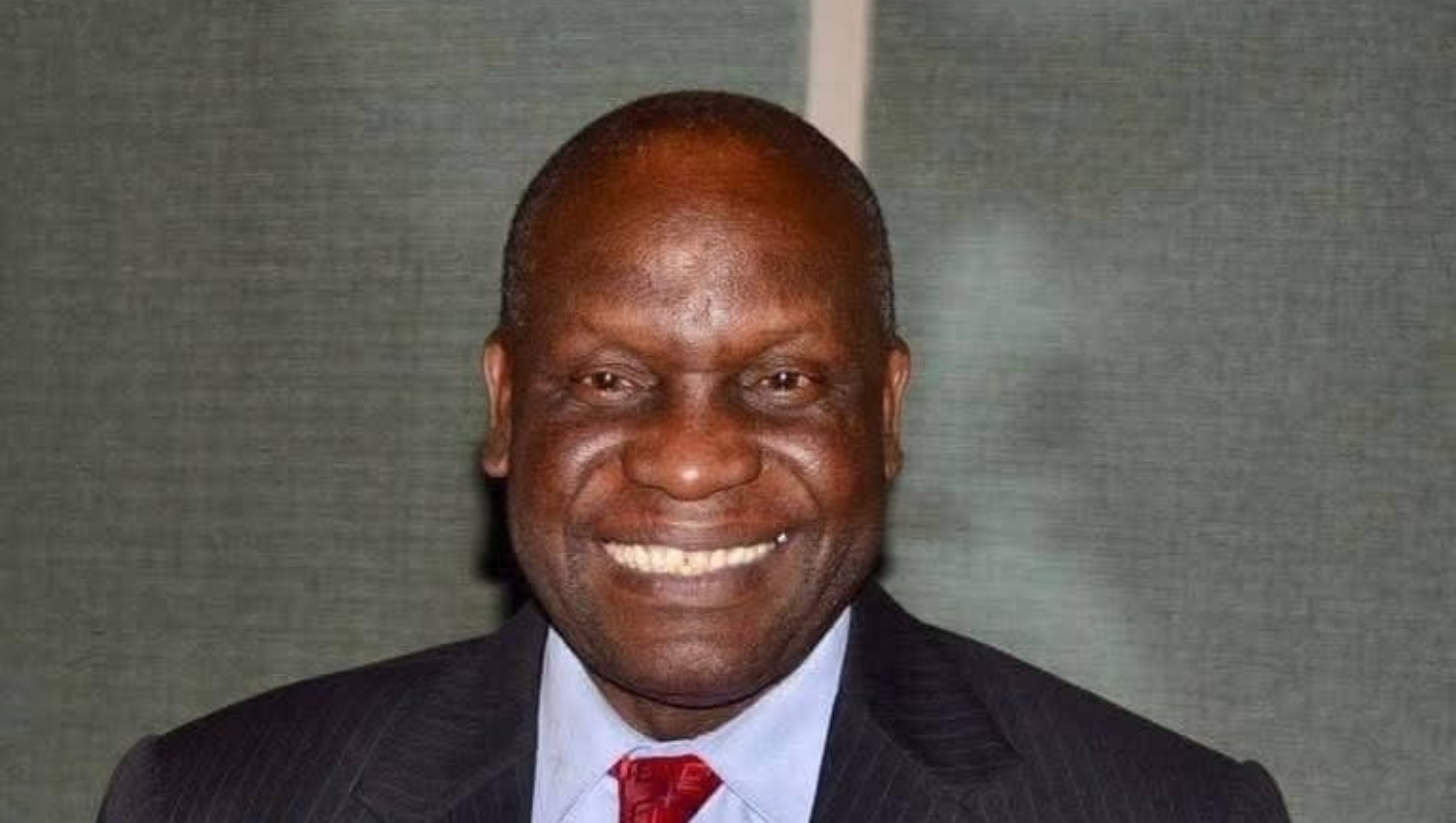

Lorraine Mwanza-Chisanga – Chairperson.

About MISA

The Media Institute of Southern Africa (MISA) was founded in 1992. Its work focuses on promoting, and advocating for, the unhindered enjoyment of freedom of expression, access to information and a free, independent, diverse and pluralistic media.